In today’s financial landscape, maintaining a healthy credit score is essential for accessing credit, securing loans, and achieving financial goals. Your credit score is a numerical representation of your creditworthiness, and it plays a crucial role in determining your eligibility for credit and the interest rates you may receive. One of the most prominent credit bureaus in India is the Credit Information Bureau (India) Limited, commonly known as CIBIL. Here’s all you need to know about CIBIL and how to boost your credit score.

What is CIBIL? CIBIL is the oldest and most well-known credit information company in India. It collects credit-related information from various financial institutions, such as banks and non-banking financial companies (NBFCs), and maintains a comprehensive credit database. Based on this data, CIBIL generates credit reports and assigns credit scores to individuals and businesses, helping lenders assess creditworthiness and manage risks.

Understanding Credit Score: Your credit score, also known as the CIBIL score, is a three-digit number ranging from 300 to 900. The higher the score, the better your creditworthiness. Lenders use this score to evaluate the likelihood of you repaying borrowed funds on time. A higher credit score increases your chances of getting approved for credit at favorable terms.

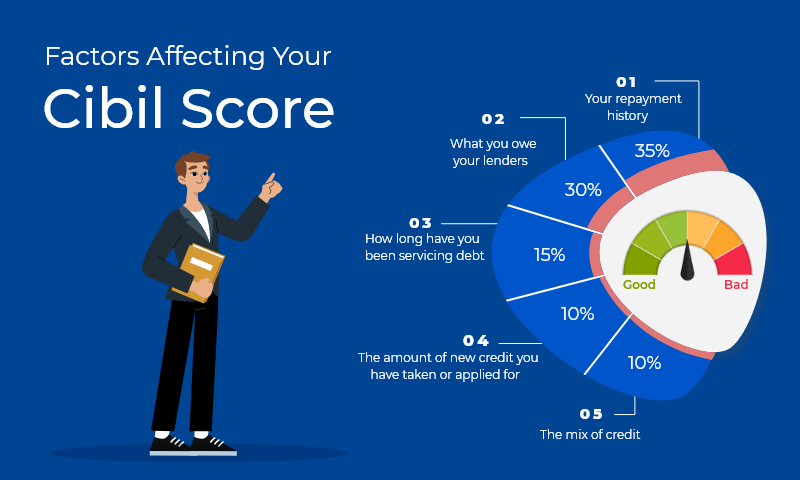

Factors Affecting Credit Score: Several factors influence your credit score, including:

- Payment History: Your track record of making timely payments on loans and credit card bills is crucial. Consistent on-time payments have a positive impact on your credit score.

- Credit Utilization: This refers to the percentage of your available credit that you’re using. Keeping your credit utilization low (typically below 30%) demonstrates responsible credit management.

- Credit Mix: A healthy credit mix that includes both secured and unsecured loans, such as credit cards and personal loans, can positively impact your credit score.

- Credit Age: The length of your credit history matters. A longer credit history demonstrates stability and responsible credit management.

- Credit Inquiries: Each time you apply for credit, a “hard inquiry” is made on your credit report. Multiple inquiries in a short period can negatively affect your credit score, as it may indicate a higher risk of default.

How to Boost Your Credit Score:

- Pay Bills on Time: Ensure timely payment of your loan installments, credit card bills, and utility bills. Late payments can have a detrimental impact on your credit score.

- Keep Credit Utilization Low: Aim to keep your credit card balances well below the credit limit. Higher credit utilization can indicate a higher risk of default.

- Maintain a Healthy Credit Mix: Maintain a balanced mix of secured and unsecured credit to demonstrate your ability to manage different types of debt.

- Monitor Your Credit Report: Regularly review your credit report for accuracy and identify any discrepancies or errors. Report any inaccuracies to the credit bureau for correction.

- Limit Credit Inquiries: Be mindful of making multiple credit applications within a short period. Instead, research and apply selectively for credit options that best suit your needs.

- Close Unused Credit Accounts: If you have multiple credit accounts that you no longer use, consider closing them. However, ensure you maintain a healthy credit mix and do not harm your credit age in the process.

- Build a Strong Credit History: Building a strong credit history takes time. Maintain responsible credit habits, make timely payments, and demonstrate good credit management practices consistently.

Remember, building and improving your credit score is a gradual process. It requires discipline, responsible credit behavior, and patience. By following these tips and maintaining a positive credit history, you can boost your credit score over time, opening doors to better financial.

Conclusion:

Understanding the importance of your credit score and how it is determined is essential for financial success. CIBIL, as one of the prominent credit bureaus in India, plays a significant role in providing credit information and generating credit scores. By focusing on factors such as payment history, credit utilization, credit mix, credit age, and credit inquiries, you can take proactive steps to boost your credit score.

Maintaining a healthy credit score opens up opportunities for accessing credit at favorable terms and achieving your financial goals. It allows you to secure loans, obtain credit cards, and negotiate better interest rates. By paying your bills on time, managing your credit utilization, diversifying your credit mix, and monitoring your credit report, you can steadily improve your creditworthiness.

Remember, building and improving your credit score is a journey that requires consistent efforts and responsible financial behavior. Take the time to understand your credit score, review your credit report regularly, and make adjustments to your financial habits as needed.